Executive Summary

Central Oregon Studio, Inc. seeks $8,850,000 in equity investment to produce three feature films, launch five revenue-generating rental businesses, and establish Central Oregon as a premier hub for film and television production.

The strategy is simple: Make a Dollar Do three Things:

1. Produce three feature films (Rowdy, The Defiled, and Operation Jericho ) that qualify for over $4 million in Oregon tax rebates and federal Section 181 job-creation incentives.

2. Use the production budgets to build five standalone subsidiary rental businesses, each with its own annual revenue stream:

-

Movie Ranch, LLC – Western Town & Military Forward Operating Base

-

Camera & Sound, LLC – Equipment Rentals

-

Grip & Electric, LLC – Lighting & Rigging

-

Props & Set Dressing, LLC – Set Decor Rentals

-

Costumes, LLC – Wardrobe Rentals

3. Establish Central Oregon as a new film and television hub beyond the Portland metro — creating jobs, training pipelines, and year-round economic growth.

With $8,850,000 in equity investment, Central Oregon Studio, Inc. will acquire 100+ acres of land, build essential infrastructure, and finance the equity portion of the three films: Rowdy, The Defiled, and Operation Jericho. The plan leverages Oregon’s 27.5% tax rebate, secured pre-sales, brand partnerships, and gap financing to stretch every dollar and maximize investor returns.

Detailed Allocation of Investment Funds

Allocation Breakdown:

Our approach reduces the capital burden on investors by using the film budgets to:

-

Construct reusable film sets (Western Town and Military Base) on the acquired land

-

Acquire equipment (cameras, lighting, sound, wardrobe, props) eligible for Oregon's tax rebate

-

Launch five subsidiary rental companies, each generating long-term revenue beyond the films

These investments create a multi-revenue ecosystem — combining film profits with asset-based rental income — and position Central Oregon Studio, Inc. as a permanent infrastructure player in the Northwest entertainment industry.

OWNERSHIP & PROFIT SHARING

Ownership and Profit-Sharing Structure

Central Oregon Studio, Inc. will serve as the parent company, managing a portfolio of revenue-generating subsidiaries. Investors receive ownership shares based on capital contributions, with a proposed 50/50 equity split between investors and the developer team.

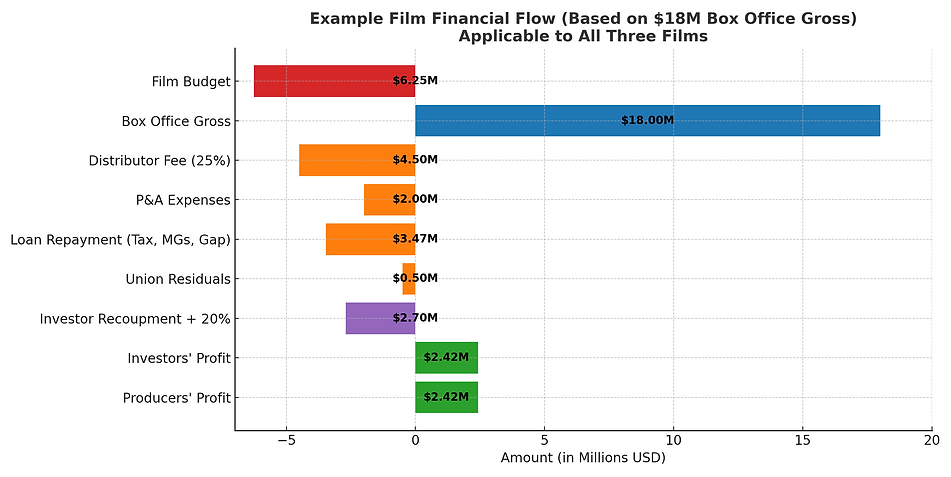

Feature Films ROI & Waterfall

Equity investors recoup 120% of principal investment before profit sharing begins. After that, net revenues are split 50/50 between investors (pro rata) and producers. Any third-party backend participants are paid from the producers’ share.

Ownership and copyrights of the films remain with the producers.

Revenue Diversification

Assets purchased through the film budgets—sets, equipment, and supplies—will be used to launch subsidiary rental businesses, including:

-

Movie Ranch, LLC

-

Camera & Sound, LLC

-

Grip & Electric, LLC

-

Props & Set Dressing, LLC

-

Costumes, LLC

-

Production Office Equipment Rentals, LLC

Each provides long-term rental income, supporting sustained revenue beyond the films themselves.

$6,750,000.00 FILM INVESTMENT

Producing Three Feature Films

A total of $6.75 million in equity will fund three feature films: Rowdy, The Defiled, and Operation Jericho, each with a production budget of $6.25M

Each film is financed through a strategic blend of:

-

Equity Investment: $2,250,000

-

Oregon Film Rebate (27.5%): ~$1,400,000

-

Pre-Sales / Minimum Guarantees: $2,000,000–$2,500,000

-

Brand Partnerships: Up to $535,000

-

Gap Loan: $10,000–$100,000

ROWDY - Budget $6.25 million

This structure lowers investor cost while delivering high-quality, commercially viable films.

Each budget also funds key production assets—cameras, grip & electric, wardrobe, props, and office gear—which will be used to create five standalone rental businesses.

Set construction two films supports the long-term revenue model:

-

The Defiled: Western Town

-

Operation Jericho: Military FOB & Afghan Village

These standing sets will anchor the Movie Ranch, LLC, generating ongoing rental income and studio infrastructure for future productions

OPERATION JERICHO - Budget $6.25 million

THE DEFILED - Budget $6.25 million

FILM FINANCING SUMMARY & INVESTOR SECURITY

Three-Film Financial Structure

These financing structures reduce reliance on equity while maximizing production value through a blend of tax incentives, pre-sales, brand partnerships, and gap financing.

All equity contributions will be held in a dedicated escrow account until each film’s full financing is secured. Funds are only released based on clearly defined milestones, such as final budget assembly, key talent attachments, insurance, bonding, and contractual compliance.

Investor Fund Security: Escrow Protection

Escrow accounts serve as impartial third-party repositories, where funds are securely held until specific conditions are met. They are commonly used by sales agents in pre-sales and distribution-driven deals to ensure transparency and protect financial commitments.

If a project does not reach full financing, investor funds will remain untouched and can be returned in full per the terms of the escrow agreement.

Ultimately, escrow facilitates trust-building among investors, distributors, talent, and other key stakeholders—ensuring that everyone is aligned and protected throughout the financing and production process.

FEDERAL & OREGON TAX INCENITVES

Federal Job Creation Incentive (Section 181)

Investors may qualify for immediate federal tax deductions under IRS Section 181, which allows up to 100% of film investment to be written off in the same year it’s spent — as long asthe production creates U.S.-based jobs and meets qualifying criteria. This reduces investor exposure and boosts after-tax ROI.

Oregon Film Rebate (Verified by State)

Our projects qualify for Oregon’s film incentive program, offering up to 27.5% in cash rebates on qualifying expenditures. Attached: Letter from Oregon Film Office confirming a $1.42M rebate estimate for Rowdy, used as an example.

These combined incentives reduce risk, enhance investor returns, and keep production dollars circulating in the local economy.

ROWDY - PROJECTED ROI

OPERATION JERICHO - PROJECTED ROI

THE DEFILED- PROJECTED ROI

MOVIE RANCH PROPERTY

Long-Term Asset & Income Source

Central Oregon Studio, Inc. will invest $1 million to acquire 100+ acres of strategically located land within 45 minutes of Redmond, Oregon. This property will anchor the Movie Ranch rental business and provide a foundation for long-term studio infrastructure.

The land will host standing sets—such as a Western Town and Military Forward Operating Base—built using film production budgets and repurposed as rentable locations.

At a rate of $15,000 per week, each set could generate between $150,000 and $600,000 annually. If both sets are booked consistently, projected rental revenue could reach $1.2 million per year.

Comparable Reference:

Blue Cloud Movie Ranch in Santa Clarita, CA charges $6,000–$10,000 per day for similar sets. With high occupancy and 245+ shoot days per year, their location rental business likely generates well over $1.9 million annually, not including add-on services. This illustrates the strong revenue potential of real estate-backed film assets in a production-friendly market.

Blue Cloud Movie Ranch, Santa Clarita, Ca

POTENTIAL ANNUAL REVENUE

FROM SUBSIDIARY RENTAL BUSINESSES

MARKETING & MARKETING POSISIONING

Using Our First Three Films to Launch the Studio

The productions of Rowdy, Operation Jericho, and The Defiled will serve as powerful marketing tools to establish Central Oregon Studio.

-

Local & National Press: Coverage in regional outlets and national trades like Variety, The Hollywood Reporter, Indiewire, IMDbPro, and Entertainment Tonight.

-

Behind-the-Scenes Content: Used for press, social media, and promotional reels.

-

Festival Exposure: Films submitted to major festivals will drive visibility for the studio and region.

Ongoing Studio Promotion Strategy

-

Direct Producer Outreach: Targeted campaigns to indie producers and location scouts.

-

Website & Location Gallery: Showcasing studio resources and Central Oregon locations.

-

Brand Partnerships: Tapping into outdoor and lifestyle brands for future co-marketing.

-

Workshops & Tours: Hosting industry events to attract productions and train local crew.

Why Central Oregon?

-

27.5% film rebate

-

No state sales tax

-

Underutilized scenic locations

-

Affordable, non-union labor

-

Strong community and government support

CONCLUSION: FOUR RETURNS FROM INVESTMENT

Central Oregon Studio, Inc. offers a rare opportunity to turn one investment into four powerful outcomes.

With a strategic $8.85 million equity investment, participants benefit from:

1. Three commercially-driven feature films with 120% ROI and 50/50 profit sharing

2. Five rental businesses generating annual revenue streams, launched from production assets:

-

Movie Ranch, LLC – Western Town & Military Forward Operating Base

-

Camera & Sound, LLC – Equipment Rentals

-

Grip & Electric, LLC – Lighting & Rigging

-

Props & Set Dressing, LLC – Set Decor Rentals

-

Costumes, LLC – Wardrobe Rentals

3. Ownership of 100+ acres of Central Oregon land, anchoring long-term value and expansion potential

4. Regional economic growth, including job creation, training pipelines, and ongoing visibility for the region

This structure minimizes investor capital through Oregon’s 27.5% rebate, pre-sales, brand partnerships, and escrow-secured funding—while maximizing returns through diversified revenue, scalable infrastructure, and long-term asset value.

It’s a bold investment strategy — designed to deliver returns, revenue, and regional impact.

INVESTMENT RISK & MITIGATION STRATEGY

All investments carry inherent risk, and film production is no exception. However, Central Oregon Studio, Inc. is structured to minimize exposure and maximize security through a multi-pronged risk mitigation strategy.

-

Escrow-Protected Capital

Investor funds are placed in escrow and are not released until the film’s full financing is secured. This ensures that no investor capital is at risk of partial funding or abandoned production.

-

Tax Incentives & Pre-Sales

Each film leverages Oregon’s 27.5% cash rebate, federal Section 181 job creation incentives, brand partnerships, and pre-sales/minimum guarantees to reduce reliance on equity and recoup costs earlier in the cycle.

-

Diversified Revenue Model

-

This is not a single-project investment. It is a scalable business that includes five standalone rental companies, long-term land ownership, and equity participation in three feature films — each with profit potential and lasting asset value.

-

-

Experienced Leadership

-

With 24+ years in the film/TV industry as an actor, stuntman, producer, and director — and as founder of two successful media companies — the leadership behind Central Oregon Studio brings both credibility and deep operational knowledge.

By combining proven financial structures, real asset acquisition, and revenue diversification, this investment strategy is built to withstand industry fluctuations and deliver long-term returns.